THIS REPORT HAS BEEN PROVIDED TO THE FBI, FINCEN, FTC, FEC, SEC, OGE, DOJ, INTERPOL AND CONGRESSIONAL INVESTIGATORS (THE MASTER REPORT IS OVER 2000 PAGES). SEE WHY:

TOXIC COMPANIES (LINK)

![]()

(LINK) HOW THE BRIBES WERE PAID IN THE CLEANTECH CRASH AND ENERGY DEPARTMENT GREEN CASH

The latest “Stimulus Funds” program called “Build Back Better” was designed by lobbyists and insiders as the largest crony payola scam in history. Of the original two trillion dollars proposed, ONE TRILLION DOLLARS of that money was for bribes and stock market payola that was going, through a tentacular, covert, set of shenanigans, into Senator’s (and their families) pockets! Almost none of the money was going to citizens. Much of the money was going to developers who were friends of the White House financiers.

(LINK) Millions in Lobbying and Billions in Stock, Hookers, Search Rigging and Real Estate Bribes!

It is easy to catch these crooks. It is hard to get law enforcement people, who are their buddies, to arrest them.

GOOGLE BRIBES POLITICIANS TO AVOID TAXES GOOGLE IS A CRIME CARTEL

_____________________________________________________________

SILICON VALLEY BRIBERY TACTIC: INFLATED SPEAKING FEES

(LINK) THE POLITICAL BRIBES DISGUISED AS “SPEAKING FEES”

_____________________________________________________________

In A FACEBOOK Post you can read the following:

“…This is about a group of U.S. Senators, Silicon Valley Oligarchs and crooked lobbyists who commit crimes in order to manipulate over a trillion State and federal tax dollars into their, and their friends, pockets. They trade bribes in the form of: Billions of dollars of Google, Twitter, Facebook, Tesla, Netflix and Sony Pictures stock and stock warrants which is never reported to the FEC; Billions of dollars of Google, Twitter, Facebook, Tesla, Netflix and Sony Pictures search engine rigging and shadow-banning which is never reported to the FEC; Free rent; Rare-Earth mining rights; Male and female prostitutes; Cars; Dinners; Party Financing; Sports Event Tickets; Political campaign printing and mailing services “Donations”; Secret PAC Financing; Jobs in Corporations in Silicon Valley; “Consulting” contracts from McKinsey as fronted pay-off gigs; Overpriced “Speaking Engagements” which are really just pay-offs conduited for donors; Gallery art; Private jet rides and the use of Government fuel depots (ie: Google handed out NASA jet fuel to staff); Recreational drugs; Real Estate; Fake mortgages; The use of Cayman, Boca Des Tores, Swiss and related money-laundering accounts; The use of HSBC, Wells Fargo, Goldman Sachs and Deustche Bank money laundering accounts and covert stock accounts; Free spam and bulk mailing services owned by Silicon Valley corporations; Use of high tech law firms such as Perkins Coie (THE KING OF HIT-JOBS), Wilson Sonsini, MoFo, Covington & Burling, etc. to conduit bribes to officials; and other means now documented by us, The FBI, the FTC, The SEC, The FEC and journalists…”

Our database efforts and FBI, SEC, FTC and Congressional reporting programs mine existing financial relays in order to destroy the use of those resources for political bribery, money laundering, payola and related corruption.

TRACKING THE BRIBES AND PAYOLA DOLLAR-BY-DOLLAR

The following are the largest money laundering banks; the full-service political cash conduit banks usually provide both advisory and financing banking services, as well as sales, market making, and research on a broad array of financial products, including equities, credit, rates, currency, commodities, and their derivatives to hide money from tax agencies and law enforcement. :[3][4]

Many of the largest crooked banks are considered among the “Bulge Bracket banks” and as such underwrite the majority of financial transactions in the world.[5] Additionally, banks seeking more deal flow with smaller-sized deals with comparable profitability are known as “Middle Market investment banks” (known as boutique or independent investment banks).[1]

Financial conglomerates

Large financial-services conglomerates combine commercial banking, investment banking, and sometimes insurance. Such combinations were common in Europe but illegal in the United States prior to the passage of the Gramm-Leach-Bliley Act of 1999. The following are large investment banking firms (not listed above) that are affiliated with large financial institutions:[6]

- ABN AMRO[7]

- BBVA

- Banco Bradesco

- Banco Santander

- BB&T (BB&T Capital Markets)

- Bank of China (BOC International Holdings)

- Bank of Communications (BOCOM International Holdings)

- Berenberg Bank

- Canadian Imperial Bank of Commerce (CIBC World Markets)

- China Construction Bank (CCB International Holdings)

- China CITIC Bank

- CIMB

- Commerzbank

- Crédit Agricole

- Daiwa Securities

- DBS Bank (Capital Markets Group)

- Desjardins Group (Desjardins Capital Markets)

- Handelsbanken

- ICICI Bank

- Industrial and Commercial Bank of China (ICBC International Holdings)

- ING Group

- Intesa Sanpaolo (Banca IMI)

- İş Bankası (Is Investment)

- Itaú Unibanco (Itaú BBA)

- KBC Bank

- KeyCorp (KeyBanc Capital Markets)

- Kotak Mahindra Bank

- Laurentian Bank of Canada (Laurentian Bank Securities)

- Lloyds Banking Group (Lloyds Bank Wholesale Banking & Markets)

- Macquarie Group

- Maybank

- Mediobanca

- Mizuho Financial Group

- Banca Monte dei Paschi di Siena (MPS Capital Services)

- M&T Bank

- National Bank of Canada (National Bank Financial Markets)

- Natixis

- Nordea

- PNC Financial Services (Harris Williams & Company)

- Rabobank

- RHB Bank

- Sanlam (Sanlam)

- SEB

- Sberbank

- Scotiabank (Scotia Capital)

- Société Générale

- Standard Bank

- Standard Chartered Bank

- State Bank of India (SBI Capital Markets)

- Stifel Financial (Stifel Nicolaus)

- Sumitomo Mitsui Financial Group

- SunTrust (Robinson Humphrey)

- TD Securities

- UniCredit (UBM)

- VTB Bank (VTB Capital)

Private placement firms

Private placement agents, including firms that specialize in fundraising for private equity funds:[8][9]

- Almeida Capital

- Atlantic-Pacific Capital

- Campbell Lutyens

- Cogent Partners

- Helix Associates

- J.P. Morgan Cazenove

- Park Hill Group

- Probitas Partners

Previous Notable former investment banks and brokerages we are tracking all clients from

The following are notable investment banking and brokerage firms that have been liquidated, acquired or merged and no longer operate under the same name.

| Firm | Fate |

| Alex. Brown & Sons | ultimately part of Deutsche Bank, survives as minor business unit |

| A.G. Becker & Co. | acquired by Merrill Lynch in 1984 |

| A.G. Edwards | acquired by Wachovia in 2007 |

| The Argosy Group | acquired by Canadian Imperial Bank of Commerce in 1995 |

| Babcock & Brown | collapsed 2009, liquidation of its assets |

| BancAmerica Robertson Stephens | acquired by NationsBank in 1998 and integrated into NationsBanc Montgomery Securities to form Banc of America Securities. |

| Barings | collapsed 1995; assets acquired by ING Bank |

| Bear Stearns | collapsed 2008; assets acquired by JPMorgan Chase |

| Bowles Hollowell Connor & Co. | acquired by First Union in 1998 |

| Blyth, Eastman Dillon & Co. | merged with Paine Webber in 1979 |

| Brown Bros. & Co. | merged with Harriman Brothers & Company to form Brown Brothers Harriman & Co. |

| BT Alex. Brown | acquired by Deutsche Bank to form Deutsche Bank Alex. Brown |

| C.E. Unterberg, Towbin | acquired by Collins Stewart in 2007 |

| Commodities Corporation | acquired by Goldman Sachs and renamed Goldman Sachs Princeton in 1997 |

| Dain Rauscher Wessels | bought by Royal Bank of Canada in 2000 |

| Dean Witter Reynolds | merged with Morgan Stanley to form Morgan Stanley Dean Witter, subsequently the Dean Witter name was eliminated |

| Dillon, Read & Company | acquired by Swiss Bank Corporation, and is ultimately part of UBS AG |

| Donaldson, Lufkin & Jenrette | acquired by Credit Suisse in 2001 |

| Drexel Burnham Lambert | liquidated 1990 |

| E.F. Hutton & Co. | acquired by Shearson Lehman/American Express in 1988, ultimately part of Lehman Brothers |

| First Boston Corporation | merged with Credit Suisse in 1988 to form CS First Boston, renamed “Credit Suisse First Boston” in 1996 and “Credit Suisse” in 2006 |

| First Union Securities | acquired by Wachovia in 2002 to form Wachovia Securities |

| G.H. Walker & Co. | acquired by White Weld & Co and ultimately part of Merrill Lynch |

| Giuliani Capital Advisors | the investment banking division of Giuliani Partners was sold to Macquarie Group in 2007 |

| Goodbody & Co. | merged into Merrill Lynch in 1970 |

| Gruntal & Co. | acquired by Ryan Beck & Co. in 2002 |

| H.B. Hollins & Co. | liquidated in 1913 |

| Halsey, Stuart & Co. | ultimately part of Wachovia |

| Hambrecht & Quist | acquired by Chase Manhattan Bank and ultimately part of JPMorgan Chase. H&Q name continues as investment advisor |

| Hambros Bank | acquired by Société Générale |

| Hayden, Stone & Co. | acquired Shearson Hammill & Co. in 1974 and assumed the Shearson name. Ultimately acquired by American Express in 1981 |

| Harriman Brothers & Company | merged with Brown Bros. & Co. to form Brown Brothers Harriman & Co. |

| HBOS | acquired by Lloyds TSB to form the Lloyds Banking Group in 2009 |

| Hill Samuel | acquired by Trustee Savings Bank (TSB) in 1987 later Lloyds TSB |

| Hornblower & Weeks | investment bank acquired by Loeb, Rhoades & Co. and ultimately part of Shearson/American Express |

| J.&W. Seligman & Co. | investment bank ultimately part of UBS AG; continues as asset manager |

| J.C. Bradford & Co. | acquired by PaineWebber in 2000, ultimately part of UBS AG |

| John Nuveen & Co. | IBD acquired by Piper Jaffray in 1999; company continues as asset management house under Nuveen Investments, which is controlled by private equity firm Madison Dearborn Partners |

| Keefe, Bruyette & Woods | acquired by Stifel in 2012, still maintain independent branding |

| Kidder, Peabody & Co. | acquired by General Electric Corporation in 1986, subsequently resold to PaineWebber in 1994 and ultimately part of UBS AG |

| Kleinwort Benson | acquired by Dresdner Bank in 1995 |

| Kuhn, Loeb & Co. | ultimately part of Lehman Brothers |

| Llama Company | ultimately defunct after departure of Alice Walton |

| L.F. Rothschild | ultimately part of C.E. Unterberg, Towbin, with parts sold to Oppenheimer. Not to be confused with Rothschild & Co (the result of a merger of the British N.M. Rothschild & Sons with the French Rothschild & Cie); see Rothschild family |

| Lee, Higginson & Co. | liquidated 1932 |

| Lehman Brothers | bankrupt in 2008, asset sold to Barclays Capital and Nomura Holdings |

| Loeb, Rhoades & Co. | acquired by Shearson Hammill & Co. to form Shearson Loeb Rhoades in 1979 which was later acquired by American Express in 1981 to form Shearson/American Express |

| McColl Partners | acquired by Deloitte in 2013 to form Deloitte Corporate Finance |

| Mendelssohn & Co. | aryanized by the Nazis in 1938, sold in parts to Deutsche Bank |

| Merrill Lynch & Co. | acquired by Bank of America in 2008 and integrated into Banc of America Securities to form Bank of America Merrill Lynch |

| Miller Buckfire & Co. | acquired by Stifel in 2012, still maintains independent branding |

| Montgomery Securities | acquired by NationsBank in 1997 and integrated into NationsBanc Capital Markets to form NationsBanc Montgomery Securities |

| Morgan & Cie | acquired by Morgan Stanley in 1967 and incorporated as Morgan et Compagnie International in Morgan Stanley International Incorporated in 1975 |

| Morgan Grenfell | acquired by Deutsche Bank in 1990 |

| Morgan, Harjes & Co. | renamed Morgan & Cie in 1926 and acquired by Morgan Stanley in 1926 |

| Paine Webber | acquired by UBS AG |

| Park Ryan | liquidated 1979 |

| Prudential Securities | acquired by Wachovia in 2003 |

| Reynolds Securities | merged with Dean Witter & Co. to form Dean Witter Reynolds, subsequently merged with Morgan Stanley |

| Robert Fleming & Co. | acquired by JPMorgan Chase |

| Robertson Stephens | acquired by BankAmerica in 1997 and integrated into BancAmerica Securities to form BancAmerica Robertson Stephens. Sold again in 1998 to BankBoston (later FleetBoston Financial and would operate as Robertson Stephens from 1998–2002, when the firm was shuttered after the collapse of the Internet bubble |

| Roosevelt & Son | Broken up into three firms in 1934: Roosevelt & Son (liquidated), Roosevelt & Weigold (today operates as Roosevelt & Cross); and Dick & Merle Smith |

| Ryan Beck & Co. | acquired by Stifel in 2007 |

| S. G. Warburg & Co | ultimately part of UBS AG; not to be confused with M.M. Warburg or Warburg Pincus; see Warburg family |

| Salomon Brothers | acquired by Travelers Group in 1997, ultimately part of Citigroup |

| Schroders | investment bank bought by Citigroup; continues as asset manager |

| Shearson/American Express | acquired Lehman Brothers Kuhn Loeb in 1984 to form Shearson Lehman/American Express, later Shearson Lehman Hutton and Shearson Lehman Brothers |

| Shearson, Hammill & Co. | renamed Shearson Loeb Rhoades after the 1979 acquisition of Loeb, Rhoades & Co. in 1979. Acquired by American Express in 1981 to form Shearson/American Express |

| Shearson Lehman Hutton | renamed Shearson Lehman Brothers in 1990 and split up in 1993 with the IPO of Lehman Brothers and the sale of the retail and brokerage operations to Primerica |

| Soundview Technology Group | ultimately part of Charles Schwab |

| Swiss Bank Corporation | merged with Union Bank of Switzerland to form UBS AG |

| Union Bank of Switzerland | merged with Swiss Bank Corporation to form UBS AG |

| Wachovia Securities | acquired by Wells Fargo in 2008 and renamed Wells Fargo Securities |

| Wasserstein Perella & Co. | bought by Dresdner Bank |

| Wertheim & Co. | acquired by Schroders, and ultimately by Salomon Smith Barney |

| White Weld & Co. | bought by Merrill Lynch |

| Wood Gundy | acquired by the Canadian Imperial Bank of Commerce in 1987, operating as CIBC Wood Gundy before becoming CIBC World Markets in 1997 |

The tech oligarchs and U.S. politicians employ a “Magic Circle” of crooked law firms to operate their schemes. The term is a derivation of the widely recognised London “magic circle” of top law firms, and is widely used in the offshore legal industry.[2][3][4][5] The term has also become used to describe the offshore legal industry in a more pejorative sense (e.g. when the general media reports on paradise papers–type offshore financial scandals),[6][7][8][9] and is therefore more sparingly used, or found, in major legal publications (e.g. Legal Business).

There is no consensus definition over which firms belong in the offshore magic circle. A 2008 article in the publication Legal Business (Issue 181, Offshore Review, February 2008) suggested a list, which has been repeated by others,[10] and is simply the top 10 offshore law firms, but excluding Gibraltar–specialist Hassans.[11][a]

- Appleby

- Bedell

- Carey Olsen

- Conyers Dill & Pearman

- Harneys

- Maples and Calder

- Covington And Burling

- Mourant Ozannes

- Ogier

- Walkers

Mofo, Brobeck, Wilson Sonsini, Perkins Coie and other tech Cartel “dirty firms” are under specific and deep investigation by both public and FBI teams. A 2017 study published in Nature into offshore financial centres (see Conduit and Sink OFCs), showed the depth of legal connections between classic “offshore” tax havens (called Sink OFCs), and emerging modern “onshore” corporate tax havens (called Conduit OFCs).

All of these entities partner with crooked CPA and Financial Planning firms ranging from:

- Arthur Andersen (until its closure in 2002 for a conviction related to the Enron scandal which was later overturned by the US Supreme Court)[4]

- Arthur Young (Arthur Young, McLelland, Moores & Co from 1968 to 1985)

- Coopers and Lybrand (until 1973 Cooper Brothers in the UK and Lybrand, Ross Bros., & Montgomery in the United States)[5]

- Deloitte Haskins & Sells (until 1978 Haskins & Sells in the United States and Deloitte & Co. in the UK)

- Ernst & Whinney (until 1979 Ernst & Ernst in the United States and Whinney Murray in the UK)

- Peat Marwick Mitchell (later Peat Marwick, then KPMG)

- Price Waterhouse

- Touche Ross

- Etc….

…to the smaller Mossack Fonseca & Co (Panama Papers) kind of boutique tax evasion and money laundering firms, of which there are thousands. A political family such as the Feinstein’s, The Pelosi’s, The Musk’s, etc. employ nearly a hundred of the types of entities listed on this page. Google’s venture capitalists and executives employ one of the largest networks of these kinds of obfuscation experts in the world.

Dense the legal relationships have become between modern economies and “offshore” tax havens via Conduit OFCs, and the rise in offshore magic circle firms setting up offices in modern corporate–focused tax havens, like Dublin.[12][13][14]

FBI investigating 'criminal enterprise' in Epstein death...

U.S. Senators Are Paid Bribes, By Big Tech, Via Their Stock Market Mutual Funds

Senators want America to think that it is “OK, if they, and their families, just own ‘Mutual Funds” in the stock market…” THEY ARE LYING. Those stock market mutual funds have tricky layers of ‘back-doors’ in them which allow Google, Facebook, YouTube, Alphabet, Elon Musk, George Soros, Eric Schmidt, and that crowd, to pay bribes to Nancy Pelosi, Kamala Harris, The Biden family, Dianne Feinstein and White House senior staff ( All of whom protect Big Tech from regulation) . David Plouffe and Steve Westly have ‘Stock Operatives’ who have provided key details…

The Tech Bribes Using The Stock Market

Every One of these financial scam tricks ( https://www.sec.gov/files/Algo_Trading_Report_2020.pdf ) is used daily by the suspects in this case:

** The Silicon Valley Stock Scam Called: “Pools“

Agreements, often written, among a group of traders to delegate authority to a single manager to trade in a specific stock for a specific period of time and then to share in the resulting profits or losses.”[5] In Australia section 1041B prohibits pooling. ( https://en.wikipedia.org/wiki/Market_manipulation#cite_note-5 )

** The Silicon Valley Stock Scam Called: “Churning“

When a trader places both buy and sell orders at about the same price. The increase in activity is intended to attract additional investors, and increase the price.

** The Silicon Valley Stock Scam Called: “Stock bashing“

This scheme is usually orchestrated by savvy online message board posters (a.k.a. “Bashers”) who make up false and/or misleading information about the target company in an attempt to get shares for a cheaper price. This activity, in most cases, is conducted by posting libelous posts on multiple public forums. The perpetrators sometimes work directly for unscrupulous Investor Relations firms who have convertible notes that convert for more shares the lower the bid or ask price is; thus the lower these Bashers can drive a stock price down by trying to convince shareholders they have bought a worthless security, the more shares the Investor Relations firm receives as compensation. Immediately after the stock conversion is complete and shares are issued to the Investor Relations firm, consultant, attorney or similar party, the basher/s then become friends of the company and move quickly to ensure they profit on a classic Pump & Dump scheme to liquidate their ill-gotten shares. (see P&D)

** The Silicon Valley Stock Scam Called: “Pump and dump“

A pump and dump scheme is generally part of a more complex grand plan of market manipulation on the targeted security. The Perpetrators (Usually stock promoters) convince company affiliates and large position non-affiliates to release shares into a free trading status as “Payment” for services for promoting the security. Instead of putting out legitimate information about a company the promoter sends out bogus e-mails (the “Pump”) to millions of unsophisticated investors (Sometimes called “Retail Investors”) in an attempt to drive the price of the stock and volume to higher points. After they accomplish both, the promoter sells their shares (the “Dump”) and the stock price falls, taking all the duped investors’ money with it.

** The Silicon Valley Stock Scam Called: “Runs“

When a group of traders create activity or rumours in order to drive the price of a security up. An example is the Guinness share-trading fraud of the 1980s. In the US, this activity is usually referred to as painting the tape.[6] Runs may also occur when trader(s) are attempting to drive the price of a certain share down, although this is rare. (see Stock Bashing) ( https://en.wikipedia.org/wiki/Guinness_share-trading_fraud )

** The Silicon Valley Stock Scam Called: “Ramping (the market)“

Actions designed to artificially raise the market price of listed securities and give the impression of voluminous trading in order to make a quick profit.[7] ( https://en.wikipedia.org/wiki/Market_manipulation#cite_note-7 )

** The Silicon Valley Stock Scam Called: “Wash trade“

In a wash trade the manipulator sells and repurchases the same or substantially the same security for the purpose of generating activity and increasing the price.

** The Silicon Valley Stock Scam Called: “Bear raid“

In a bear raid there is an attempt to push the price of a stock down by heavy selling or short selling.[8] ( https://en.wikipedia.org/wiki/Market_manipulation#cite_note-8 )

** The Silicon Valley Stock Scam Called: “Lure and Squeeze“

This works with a company that is very distressed on paper, with impossibly high debt, consistently high annual losses but very few assets, making it look as if bankruptcy must be imminent. The stock price gradually falls as people new to the stock short it on the basis of the poor outlook for the company, until the number of shorted shares greatly exceeds the total number of shares that are not held by those aware of the lure and squeeze scheme (call them “people in the know”). In the meantime, people in the know increasingly purchase the stock as it drops to lower and lower prices. When the short interest has reached a maximum, the company announces it has made a deal with its creditors to settle its loans in exchange for shares of stock (or some similar kind of arrangement that leverages the stock price to benefit the company), knowing that those who have short positions will be squeezed as the price of the stock sky-rockets. Near its peak price, people in the know start to sell, and the price gradually falls back down again for the cycle to repeat.

** The Silicon Valley Stock Scam Called: “Quote stuffing“

Quote stuffing is made possible by high-frequency trading programs that can execute market actions with incredible speed. However, high-frequency trading in and of itself is not illegal. The tactic involves using specialized, high-bandwidth hardware to quickly enter and withdraw large quantities of orders in an attempt to flood the market, thereby gaining an advantage over slower market participants.[9] ( https://en.wikipedia.org/wiki/Market_manipulation#cite_note-9 )

** The Silicon Valley Stock Scam Called: “Cross-Product Manipulation“

A type of manipulation possible when financial instruments are settled based on benchmarks set by the trading of physical commodities, for example in United States Natural Gas Markets. The manipulator takes a large long (short) financial position that will benefit from the benchmark settling at a higher (lower) price, then trades in the physical commodity markets at such a large volume as to influence the benchmark price in the direction that will benefit their financial position.

** The Silicon Valley Stock Scam Called: “Spoofing (finance)“

Spoofing is a disruptive algorithmic trading entity employed by traders to outpace other market participants and to manipulate commodity markets. Spoofers feign interest in trading futures, stocks and other products in financial markets creating an illusion of exchange pessimism in the futures market when many offers are being cancelled or withdrawn, or false optimism or demand when many offers are being placed in bad faith. Spoofers bid or offer with intent to cancel before the orders are filled. The flurry of activity around the buy or sell orders is intended to attract other high-frequency traders (HFT) to induce a particular market reaction such as manipulating the market price of a security. Spoofing can be a factor in the rise and fall of the price of shares and can be very profitable to the spoofer who can time buying and selling based on this manipulation.

** The Silicon Valley Stock Scam Called: “Price-Fixing“

A very simple type of fraud where the principles who publish a price or indicator conspire to set it falsely and benefit their own interests. The Libor scandal for example, involved bankers setting the Libor rate to benefit their trader’s portfolios or to make certain entities appear more creditworthy than they were.

** The Silicon Valley Stock Scam Called: “High Closing (finance)“

High closing is an attempt to manipulate the price of a security at the end of trading day to ensure that it closes higher than it should. This is usually achieved by putting in manipulative trades close to closing.

** The Silicon Valley Stock Scam Called: “Cornering the market“

In cornering the market the manipulators buy sufficiently large amount of a commodity so they can control the price creating in effect a monopoly. For example, the brothers Nelson Bunker Hunt and William Herbert Hunt attempted to corner the world silver markets in the late 1970s and early 1980s, at one stage holding the rights to more than half of the world’s deliverable silver.[10] ( https://en.wikipedia.org/wiki/Market_manipulation#cite_note-TEXAS-10 ) During the Hunts’ accumulation of the precious metal, silver prices rose from $11 an ounce in September 1979 to nearly $50 an ounce in January 1980.[11] ( https://en.wikipedia.org/wiki/Market_manipulation#cite_note-NYT-11 ) Silver prices ultimately collapsed to below $11 an ounce two months later,[11] much of the fall occurring on a single day now known as Silver Thursday, due to changes made to exchange rules regarding the purchase of commodities on margin.[12] ( https://en.wikipedia.org/wiki/Market_manipulation#cite_note-TimeBubble-12 )

** The Silicon Valley Stock Scam Called: “The Conduit Double Blind“

In this scam, government money is given to a Tesla, Solyndra, etc. who then money launder the cash through executive-held 501 c3 and c4 charities; and company assets and then provide DARK MONEY cash and services to political campaigns like Obama and Clinton election funds. In the case of Tesla, Google (an investor and boyfriend of Musk) supplied billions of dollars of web search rigging. Stock ownership in the companies and deals is traded for campaign funds. David Brock is a master of this kind of Dark Money money-laundering for political campaigns using PACS and pass-through spoofing.

Tesla and Solyndra investors have used ALL of the above tactics and more. Goldman Sachs and JP Morgan have thousands of staff who PROVIDE these stock market manipulation tricks to people like Elon Musk, Larry Page, Eric Schmidt, et al. These kinds of financial crimes and corruption account for the manipulation of over ONE TRILLION DOLLARS of ill-gotten profits annually!

Given the massive stimulus packages that are in force today and expected to be implemented going forward, regulators need to set clear guidelines for how and when such privileged information can be disclosed, and impose rigorous trading restrictions for investors with access to private information. Failure to do so always gives unfair advantage to some and damages the level playing field in financial markets.

To avoid providing such unfair advantage to selected executives, the SEC and the Department of Justice need to develop new procedures to incorporate potential illegal transactions derived from information about government intervention through diverse channels. Plaintiffs advocate for a more transparent and consistent protocol on information disclosure regarding government’s loan programs to prevent similar events from recurring. For example, the government could channel the release of news about COVID-19-related stimulus interventions through a common platform to prevent leakage from diverse sources and reduce information asymmetry among investors.

The DFC loan to Kodak is the first of its kind under the Defense Production Act but not the first ever because GOVT already created the pump-and-dump scheme for tech oligarchs. Nobody should be surprised by Kodak trying a proven corruption scam. Since we are in unprecedented times, government agencies and regulators need to make changes to adapt to the current situation and fulfill their mission to ensure a level playing field for investors even during this difficult period. Regulation never happens in theses scams because most California Senators and their families profit from these crimes and corruption.

SILICON VALLEY BRIBES CONGRESS WITH INSIDER TRADING TIPS AND STOCK GRANTS TO THEIR FAMILIES!

-

Potential Defendants include State And Federal Agencies and their executives. The assets, bank accounts and high recovery values of these targets are known and documented by public forensics experts. The evidence and subpoena-capable reinforcement of that evidence is substantial in this matter.

-

The targeted parties have been forensically tracked to illicit campaign financing, hacking, bribes, political payola, stock-market rigging, slush-funds, false-front shell corporations and family trusts, abuse of corporate funds, advertising metrics frauds, RICO statute violation organized crime, employee abuse, electronic communications intended to evade law enforcement and other charges. In Palantir, XKeyScore, ICIJ, SEC, FINCEN and other law enforcement databases the financial records of these crooks, and their families, are all cross-linked and clearly show the bribery and payola. Terminations and interdictions for each party and their illicit actions have been continuing successfully. The termination of this network of parties will, effectively, terminate The Cartel in question. Each and every legal take-down has now passed the 50% vector and is proceeding to completion.

-

Real estate developers, Social media oligarchs, Sand Hill Road VC’s and Big Tech CEO’s pay the largest, and most diverse, set of bribes!

Tech oligarchs tightening their payola grip on Democrats with epic bribes

The fundamental contradictions, as Karl Marx would have noted, lie in the collision of interests between a group that has come to epitomize self-consciously progressive megawealth and a mass base which is increasingly concerned about downward mobility. For all his occasional populist lapses, President Obama generally has embraced Silicon Valley as an intrinsic part of his political coalition. He has even enlisted several tech giants – including venture capitalist John Doerr, LinkedIn billionaire Reid Hoffman and Sun Microsystems co-founder Vinod Khosla – in helping plan out Obama’s no-doubt lavish and highly political retirement.

In contrast, Hillary Clinton is hardly the icon in the Valley and its San Francisco annex as are both her husband and President Obama. But her “technocratic liberalism,” albeit hard to pin down, and close ties to the financial oligarchs seems more congenial than the grass-roots populism identified with Bernie Sanders, her chief rival for the Democratic presidential nomination.

“They don’t like Sanders at all,” notes researcher Greg Ferenstein, who has been polling Internet company founders for an upcoming book. Sanders’ emphasis on income redistribution and protecting union privileges and pensions is hardly popular among the tech elite. “He’s an egalitarian liberal,” Ferenstein explains, “These people are tech liberals. Equality is a nonissue in Silicon Valley.”

This conflict is most obvious in the assault on ride-booking firms, like Uber, by progressives like Sanders, as well as New York City Mayor Bill de Blasio. This battle reveals a deepening split between the party’s mass base, including conventional taxi companies and operators, and its increasingly influential tech business allies.

Some conservatives, such as pollster Scott Rasmussen, see Republican backing for Uber as an opening for the GOP. Yet Ferenstein’s poll of Internet founders reveals that barely 3 percent say they are Republicans; 18 percent are libertarian, while nearly half are Democrats. Republican operatives peg the tech donors to be 9-1 in favor of Democrats. Talk about unrequited love!

Overall, the hotbeds of the tech and information economies, including media, have become the financial bedrock of the Democratic Party. The 10 leading counties for Democratic fundraising in 2012 included, for the first time, Santa Clara, as well as San Francisco, Los Angeles and New York. Given their domination of the ranks of wealthy people under age 40, one can expect that this power will only increase in the years ahead.

This suggests that the tech elite, far from deserting the Democratic Party, more likely will aim take to it over. They are doing this, as other industries have, by absorbing key party operatives. Uber, for example, uses Obama campaign manager David Ploufee to lead its public relations, while other former officials have joined other tech firms such as Airbnb, Google, Twitter and Amazon.

Colliding Worldviews

This conflict between populists and tech oligarchs has been muted in the past, in large part due to common views on social issues like gay marriage and, to some extent, environmental protection. But as the social issues fade, having been “won” by progressives, the focus necessarily moves to economics, where the gap between these two factions is greatest.

Fundamentally, Silicon Valley worships at the altar of “disruption,” seeking ways to create at least the prospect of megaprofits by doing things differently. Change is celebrated by those who benefit the most from it. But groups – from cab drivers to Hollywood tradespeople, even hotel workers – whose livelihoods are threatened by the disruptions of the “share” economy, may not be so sanguine.

Other aspects of the Silicon Valley mentality – what Ferenstein calls “the politics of the creative class” – reveal the unconscious elitism of its worldview. Although their industry is overwhelming based amid the Bay Area’s suburban sprawl, the Internet oligarchs, he claims, want “everyone” to move in to the urban center, something not remotely practical for most middle- and working-class families. Other policies advocated by the oligarchs, such as pushing for ever-higher energy prices, don’t threaten their lifestyles but are devastating to the classes below them.

Perhaps the biggest area of disagreement between the oligarchy and the populists is the role of labor unions. Simply put, the oligarchs are, at best, indifferent, if not hostile, to union influence. After all, tech has blossomed virtually without organized labor, which remains a bulwark of Democratic operations. Silicon Valley-backed attempts to reform schools, or weaken pensions for government workers, can expect ferocious opposition from the unions.

Another potential dividing line can be seen on immigration, where left-leaning groups like the Economic Policy Institute have campaigned against attempts by establishment Democrats and Republicans alike to expand the H1B and other “guest worker” visa programs. In a moment of politically incorrect candor, Sen. Sanders suggested that the kind of “open borders” policy advocated by Silicon Valley, libertarians and immigration activists would result in “substantially lower wages” for working-class Americans.

Progressivism’s future?

Right now, the populists have numbers on their side, as well as much of the media. The recent New York Times expose on Amazon’s brutal management practices reveals a deep discord between the media mouthpieces of the political Left and their usual capitalist heroes from the information economy.

The biggest challenge for the tech oligarchs is that their rise has come as class divisions have widened, and inequality has grown. The benefits to society of the current technology wave – outside of being able to more conveniently waste time on your phone – whether in terms of creating jobs (outside of the Bay Area) or boosting productivity, appear largely limited.

Yet given what many find the unattractive nature of the Republican alternative, one can expect the oligarchs to seek out a modus vivendi with the populists. They could exchange a regime of higher taxes and regulation for ever-expanding crony capitalist opportunities and political protection. As the hegemons of today, Facebook and Google, not to mention Apple and Amazon, have an intense interest in protecting themselves, for example, from antitrust legislation. History is pretty clear: Heroic entrepreneurs of one decade often turn into the insider capitalists of the next.

Tech people certainly have no objection to joining the ranks of crony capitalists, notably when cloaked in environmentally green garb. The solar energy and electric car empire of Elon Musk has been made possible by subsidies; unlike most manufacturing industries, he has a well-developed interest in the most Draconian energy legislation. Other tech figures, including Doerr, Khosla and top executives at Google, have benefited from government-subsidized renewable-energy schemes.

THE POLITICAL BRIBES DISGUISED AS “SPEAKING FEES”

These ventures produce very expensive energy – an economic disaster for most Californians – but have been bolstered by alliances with unions, which seek to monopolize construction within green industries. Rather than seek at least some alliance with the Right, it seems more likely that the oligarchs will be forced to make some concessions to the populist Left, including to women and minorities, groups unrepresented in the tech industry.

A possible model for such an alliance can be seen in the coupling of San Francisco hedge-fund billionaire environmentalist Tom Steyer and his Latino sidekick, the now-well-funded climate-change acolyte state Senate President pro Tem Kevin de León of Los Angeles, by such things as using cap-and-trade funds to fund a relatively small number of affordable houses. With the industrial economy hampered by regulation, the old blue-collar economy is dying off. This means the oligarchs may need only to support a few symbolic measures to benefit those who no longer have a productive place in the economy.

Steyer even has plans in 2018 to succeed Gov. Jerry Brown, who he thinks may not have been sufficiently Draconian in his campaign against climate change. Steyer will probably be able to count on the support of de León and other Latino politicians whom Steyer finances.

The new platform would be a combination of climate change militancy and redistribution of wealth to the poor who, due in large part to the policies advocated by Silicon Valley, have little hope of moving up economically, much less buying a home in our state. This “upstairs downstairs” coalition – largely indifferent to the interests of the traditional middle class or working class – may well represent the future of the Democratic Party, initially in the Golden State and, increasingly, nationally.

Of course, Bernie Sanders may yet have his moment, but the America he represents, that of sure things and widespread equality, will fade with him. The economic future likely belongs not to the populists but to the oligarchs and those in politics who choose to tap their money and influence to gain power. Welcome to the 21st century.

Joel Kotkin is the R.C. Hobbs Fellow in Urban Studies at Chapman University in Orange and the executive director of the Houston-based Center for Opportunity Urbanism (www.opportunityurbanism.org).

His most recent book is “The New Class Conflict” (Telos Publishing: 2014).

HERE ARE THE BRIBES “JOHN” WITNESSED AT THE WHITE HOUSE AND IN PALO ALTO:

– Federal bribes are never clean. They always become complicated because of the “I want some too” factor

– The transactions, and documented quid pro quo, not only qualify for, but exceed, the requirements for Federal Racketeering indictments

– When an adjacent entity finds out there is a bribe going on, they can use the knowledge of the bribe to extort sub-bribes

– BRIBE 1 = Free NASA jet fuel, NASA partial agency closure and exclusive private supplier contracts to Space X, NASA Ames airport exclusive hand-over for Google & billionaire jets as payback for campaign resources

– BRIBE 2 = Exclusive free federal taxpayer cash from Department of Energy in spite of low credit ratings and failing reviews in actual side-by-side comparisons of ALL applicants

– BRIBE 3 = Exclusive tax credits, exclusive carbon credits, exclusive factory fee discounts, exclusive employee tax waivers, and land discounts from state underwritten by feds

– BRIBE 4 = First position in federal contract allocations

– BRIBE 5 = Real estate discounts and ongoing revenue upsides from contiguous Tesla/Solyndra real estate and pass-along leases which Senator Feinstein’s family exploited

– BRIBE 6 = Loans by Billonaire campaign backers who were investors in Google, Tesla and “CleanTech” to Senators campaign PACs and funds

– BRIBE 7 = Loans by Billonaire campaign backers who were investors in Google, Tesla and “CleanTech” to DNC and Presidential campaign office campaign PACs and funds via conduited means

– BRIBE 8 = Payments of campaign bills by Billionaire campaign backers who were investors in Google, Tesla and “CleanTech via conduit-ed means

– BRIBE 9 = Provision of Search Engine manipulation, mood manipulation and competing interest web-search deletion on Silicon Valley global web architecture

– BRIBE 10 = Sex workers as deal incentives

– BRIBE 11 = Provision of federal funds and filings in a manner intended to be used for, and which were used to alter SEC securities filings, aligned with manipulated news distribution by insiders in order to defraud the stock market and falsify stock values for personal profit relative to Tesla, Solyndra, Abound, Fisker and related entities

– BRIBE 12 = The service, provided by the Department of Energy, whereby all competitors to the stock portfolios of the Billonaire campaign backers who were investors in Google, Tesla and “CleanTech” were terminated, stone-walled and review-manipulated by the actions of the Department of Energy

– BRIBE 13 = Revolving door jobs for White House and DOE staff in exchange for favorable federal decisions

– BRIBE 14 = Custom authored white-papers by McKinsey Consulting, the content of which was directed by Billionaire campaign backers, who were investors in Google, Tesla and “CleanTech, and Steven Chu, Steven Spinner and Matt Rogers, who then became the heads of the DOE funding. These White Papers were distributed to the White House and Congress by lobbyists working for the Billionaire campaign backers who were investors in Google, Tesla and “CleanTech”. The white-papers were constructed in order to give a false impression of Clean-tech and happened to favor only the stock investments of Billionaire campaign backers, who were investors in Google, Tesla and “CleanTech”. The manipulated white-papers were used to sell Congress, via contrived data, on plans beneficial only to the Billionaire campaign backers, who were investors in Google, Tesla and “CleanTech

– BRIBE 15 = Possible terminations. An inordinately large number of individuals connected to this bribe died during this event. All of the deaths were unexpected, untimely, non-indicated by current medical conditions and game-changing by ironically reducing the risk of exposure in most of the cases

– BRIBE 16 = Orders by White House staff, to DOJ, SEC & FBI to “leave this matter alone for now”. Ordered failure-to-enforce

– BRIBE 17 = Senior position Jobs at DOE and DOJ

– BRIBE 18 = Lack of review, “don’t observe” process as Solyndra, Abound, Fisker, etc. were immediately failing. Orders to avoid noticing the failures in order to cover up campaign negatives

– BRIBE 19 = Down-favoring of non portfolio and competing technologies by the Department of Energy via Steven Chu, thus removing them from support and off the playing field

Corrupt Susan Wojcicki Bribes Politicians To Keep From Getting Grilled By Congress

BRIBED JUDGES ARE GETTING TO PANDEMIC LEVELS: CROOKED JUDGES, THE CONFLICTED AND THE BRIBED 1.2

ELON MUSK PAYS HUGE BRIBES TO AVOID REGULATION AND DEEPER INVESTIGATIONS INTO HIS LARCENY: DEMAND FOR CONGRESSIONAL INVESTIGATION OF TESLA MOTORS ELON MUSK IS A LIAR SCAMMER POLITICAL BRIBERY CROOK

U.S. DEPARTMENT OF ENERGY ACCEPTS BRIBES DAILY:

SILICON VALLEY BRIBERY TACTIC: HAVE YOUR SENATOR INVEST IN YOUR SCAM TECH COMPANY; CRASH THE COMPANY; SENATOR MAKES PROFIT ON THE TAX WRITE-OFF; LIKE THIS:

So who are these guys engaging in these bribes? A recent WikiPedia writer posts this description:

“– The perpetrators operate a massive and abusive sex cult. The Sandhill Road Venture Capital offices, located between Highway 280 to Santa Cruz Avenue in Menlo Park, California, house the main perpetrators of this global cartel. Their executives at Google, Facebook, Netflix, Linkedin, Twitter, and their related holdings, comprise the rest. Their sex cult actions have been widely covered in the news individually in the Joe Lonsdale rape case, The Kleiner Perkins Ellen Pao sex abuse lawsuit, The Eric Schmidt sex penthouse stories, The Jeffrey Epstein case, The Google Forrest Hayes hooker murder case, The Andy Rubin sex slave case, The Sergy Brin 3-way sex romp scandal, The British Hydrant investigation, The Elon Musk Steve Jurvetson billionaire sex parties scandals,The NXIVM sexual slave cases, The Michael Goguen anal sex slave trial, and thousands of other cases and federal divorce court filings. This group of people have proven themselves, over and over, to be sociopath control freaks not fit for participation in public commerce, public policy or media control. The Four Seasons Hotel and Rosewood Hotels in Silicon Valley are estimated to engage in over $30,000.00 of high-end escort sex trafficking per day, a portion of it managed by Eastern Bloc Mafia operators. At least 10 Ukrainian escorts fly in and out of SFO and SJO airports every week for these Cartel members.

– The press has widely reported on underage boy sex clubs and the payment to parents for the blood of young boys by these oligarchs. A large number of tech VC’s and senior executives are covert gay activists who hire women to act as their “beards”. Their elitist Yale and Stanford fraternity house upbringings promoted “bromances”, “rape culture” and a don’t-worry-daddy-will-fix-it mentality.

– The AngelGate Conspiracy ( https://venturecapitalcorruption.weebly.com/the-angelgate-conspiracy.html ); The Job Collusion Case ( https://en.wikipedia.org/wiki/High-Tech_Employee_Antitrust_Litigation ) and hundreds of other cases, prove that the perpetrators regularly meet, conspire, collude and racketeer, in full view of law enforcement, without ever getting arrested by the FBI because they bribe public officials in order to avoid prosecution. The perpetrators operate in extreme violation of federal RICO laws yet no DOJ or SEC RICO case has been filed against them by federal officials.

– The perpetrators have used their exclusive monopolized cash flow of taxpayer financed grants, contracts and internet infrastructure to purchase the majority of the political lobby firms and technology law firms in America. This gives them an illegal, illicit and unfair ability to control: 1.) which laws are made or stalled, 2.) who gets government funded or blocked, 3.) Who gets tax breaks, tax credits and tax waivers and who does not, 4.) Who gets state-sponsored reprisal targeting or benefits blockades, 5.) Who gets revolving door payola jobs at their companies, 6.) Who gets PAC money bribes, 7.) and many other effects that are legally defined as “racketeering”.

– The perpetrators conspire, coordinate and manually manipulate their digital media mass broadcasts in order to collude in a manner that injects coordinated subliminal messages, that no regular voting citizen can detect, into their media in order to manipulate co-aligned political and ideological messages that will promote their ideological beliefs and promote public and policy actions which will provide profits to their stock market holdings which they co-own. Many of those stock market holders, (ie: in Tesla, Google, Abound, Solyndra, rare earth metals, Disney, etc) were coordinated between all of the perpetrators by their partners at JP Morgan, Bear Stearns, Goldman Sachs in such a manner as to collude to rig markets via insider trading ownership’s that U.S. Senators, and their families, shared.

– The perpetrators have used their subliminal media control technologies to manipulate every national election since 2008.

– The perpetrators use a contrived Scientology-like hiring and HR management system which seeks out the most vulnerable, naive, easily influenced, and damaged people to fill their employee coffers with, in order to do their bidding. Their employees are nothing less than tools, sheep and fodder for their media manipulations, sexual abuses and ego-mania.

– These people are absolutely evil, sick and sociopath-like individuals who operate with impunity because they are never arrested. They thumb their noses at the law and anyone who does not agree with them. They create fake political issues to milk the emotions of the public in order to gain power.”

![]()

Another posting describes Silicon Valley like this:

“The Palo Alto Mafia is an ad hoc organized crime group that violates RICO racketeering laws by engaging in dark money political corruption.

These mobsters use covert dark money schemes to direct elected officials to take public tax money and put that money in their pockets and the pockets of their campaign financier associates while using government resources to sabotage competitors. They pay the bribes to the political officials via stock market warrants, prostitutes, credit cards, real estate, mortgages, loans, revolving door jobs, contracts and other dark money.

Counter-measures against these criminals are aimed at making sure they are exposed, doxed, shamed and arrested! Private/public databases have been created to track and destroy all of their stock market holdings, Silicon Valley monoplies, off-shore spider holes, covert payola trusts, hidden shell corporations, sex trafficking clubs, emails, credit cards, stock accounts, covert real estate holdings, tax write-off profit fronts and other illicit assets.

They accrued money and power by creating mass hyper-scaled monopolies, mostly in new digital markets, by exploiting exclusive government financed resources provided by laws, grants and contracts that the politicians, that they owned, produced exclusively for them while locking out their competitors.

Although often exposed in such cases as the “AngelGate Collusion Case”, “The Silicon Valley No Poaching Class Action Lawsuit”, “The Damore Case”, and hundreds of other cases, their ownership of the senior executives at FBI, SEC, FTC, FEC, OSC, DOJ and other enforcement agencies has, so far, prevented their formal interdiction.

While using billions of dollars of PR agencies to promote a “crunchy-granola”, we-are-saving-the-world, “goodie-two-shoes” image for each of themselves, behind the scenes they conspire, collude, sex traffic, bribe, spy, black-list, payola, media bias control, censor, abuse and use Democracy as their play-thing for their sociopath addictions to power and money.

They bankrupted old-school print media and replaced it with digital media which they control to promote only their profiteering ideology. They control almost all search engines and media servers to rig them to censor public information and mass manipulate social perspectives using the automated tactics exposed in documentaries like: “The Creepy Line” and 60 Minutes segments about “Information brokers”.

They pay their bribes to their politicians and operatives using dark money relayed by corrupt law firms, lobbyists, media services and character assassination services like IN-Q-Tel; Gawker Media; Jalopnik; Gizmodo Media; K2 Intelligence WikiStrat; Podesta Group; Fusion GPS; Google; YouTube; Alphabet; Facebook; Twitter; Think Progress; Media Matters; Definers; Black Cube; Roger Stone, Mossad; Correct The Record; Sand Line; Blackwater; Stratfor ; ShareBlue; Wikileaks; Cambridge Analytica; Sid Blumenthal; David Brock; Covington and Burling, Perkins Coie, Wilson Sonsini and hundreds of others…

There are over 150 sudden, unexpected, suspicious deaths associated with person’s who were at odds with this organized crime group ranging from “suicides”, strange accidents and clear murders.

The tremendous number of sex scandals this group has been involved in are related to their need to control others, a key character trait of the sociopath psychological profile demonstrated by the majority of them.

They instruct the HR staff of the companies they own to only hire naive young employees that will appear to follow their echo-chamber-optimized, highly controlled corporate ideology culture. Any who fall out of proper “group-think” are fired until they have culled a perfect clone army of indoctrinated followers to push their political and profiteering control goals.

A large number of them are homosexual, subscribe to the Jewish cultural social training and are deeply influenced by collegiate fraternity and sorority teachings about social roles and elitism.

They are known by a number of names including:

“The PayPal Mafia”

“The Silicon Valley Oligarchs”

“The Deep State”

“The Billionaire Frat Boy Club”

“The Bohemian Club”

“The KPCB Cosa Nostra”

“The Guardsmen Club”

“The Greylock Greys”

and other AKA’s

This mob has so much cash from unjust gains, and hires so many out-of-control lobbyists and defamation services, that they have totally broken the Democratic process.

Together they use the key political tactic of “heart-string” stock market pumping.

They deploy a coordinated PR program that hypes a certain fabricated “issue” which will end up increasing the valuation of stock market stocks they own.

“Immigration” creates more DNC voters which allow them to control more Senators who, in return, create more policies which increase the valuation of the Mafia’s stock market holdings at JPMorgan and Goldman Sachs.

“Climate Change” causes more government cash for the solar panels, wind farms, lithium ion batteries and electric cars which the Palo Alto Mafia owns the exclusive rights to. The more they can push a “crisis” perception about climate change, the more cash they can put in their pockets. Goldman Sachs is the “advisor” for Tesla, Solyndra and most “green” Mafia companies.

The private profits of this scheme involve over SIX TRILLION DOLLARS of tax money. That is why they will lie, cheat, steal and even kill to keep their plot going.

The top ways to prevent these crimes are to 1.) outlaw lobbying and 2.) create a ten year moratorium of politicians working in politics. The Palo Alto Mafia spends over 16 BILLION DOLLARS per year in lobbying efforts to prevent this from happening.

The Palo Alto Mafia self-deludes and echo-chambers their peers into a frenzy of increasingly violent thought about all those who oppose their schemes and covertly supports ANTIFA as a surrogate entity so that they can sit in their Woodside mansions and “remote-control” disruptions and political resistance.

In fact, they are sociopath criminals deserving arrest by federal police and prosection under RICO Racketeering laws…”

SILICON VALLEY BRIBERY TACTIC: BRIBING “JOURNALISTS” TO COLLUDE TO PUT “YOUR” CANDIDATE IN OFFICE THAT PROMISED YOU THE GOVERNMENT GRANTS AND CONTRACTS:

In this REDDIT posting, you can see the darkest view of this crowd:

“…– That these FBI-filed facts are not ‘Conspiracy Theories’ but daily occurrences in politics as proven by every major news outlet in the world, federal court records, FBI records and Congressional investigation reports.

- – That we are federal whistle-blowers and business competitors of public officials who operated illegal and Constitutional-rights-violating reprisal hit-jobs and attacks against us using taxpayer financed resources.

- – That State and Federal agencies owe us money, and other consideration, to pay for our: 1.) Damages, 2.)losses, 3.) benefits blockades, 4.) witness fees, 5.) whistle-blower fees, 6.) informant fees, 7.) punitive compensation, 8.) legal costs and other items caused by criminal corruption, reprisal attacks and illicit quid-pro-quo operations within their government offices by their government employees, contractors and covert financiers.

- – That a Smedley Butler-style ‘Business Plot’ crime program exists between Silicon Valley Tech Oligarch billionaires, investment banks, U.S. Senators, government agency staff and White House staff to engage in these crimes.

- – That public officials knowingly participate in these crimes by failing to report their associates who engage in these illicit actions and by hiring Google, Fusion-GPS and Black Cube-type suppliers who operate these illicit activities in revolving door schemes.

- – That the suspects manipulate government funds for their personal profiteering at the expense of domestic citizen taxpayers like us and acquire what the U.S. Treasury calls: “unjust gain”.

- – That the suspects operate a vast stock market manipulation program, as a core function of their operations, and exchange most of their bribes via the stock market and those illicit deeds function at the expense of the public.

- – That the suspects contract a known group of lobbyists, corrupt law firms, unethical CPA’s, corrupt investment banks and specialized corruption services providers to attack, defame, physically harm, character assassinate (Using their Google, Youtube, Gizmodo, Fusion GPS, Black Cube, UC Global, Media Matters, et al, “kill” services), black-list and harm those they dislike and that they harmed us with those actions.

- – That the suspects operate an Epstein-like sex-trafficking network network of prostitutes and sexual extortion activities and locations for the engagement of said activities and for the bribery of cohorts via sex workers.

- – That the suspects engage in electronic attacks ( https://www.privacytools.io ) and manipulations including hacking, election manipulation, media censorship and internet search results manipulation in order to mask their schemes.

- – That we have yet to find a single Palo Alto Sandhill Road VC in this group who is not involved in bribery, racism, sexism, tax evasion, sex trafficking, black-listing, securities law violations, violent abuse, off-shore money-laundering, FEC violations, search engine manipulation, massive anti-trust violations, patent theft and other crimes!

- – That the suspects engage in ‘Lois Lerner’ IRS-like, SPYGATE-like, VA whistleblower-like reprisal and retribution attacks by manipulating resources within government agencies like SSA, DOJ, FBI, LSC, HUD, HHS, DOE, Etc….”

AntiCorruption-Policy-2011-UK ELON MUSK IS A LIAR SCAMMER POLITICAL BRIBERY CROOK

Big Tech Companies Spend Millions On California Political Bribes To Senators And Guv

SACRAMENTO — Gov. Gavin Newsom solicited donations totaling nearly $227 million from Facebook, Google, Blue Shield and other private California companies and organizations to combat the coronavirus pandemic and help run parts of his administration, according to a report Thursday by the state’s political watchdog agency.

“Behested payments” are contributions solicited by an elected official to be given to another individual or organization. They are less regulated than campaign contributions and grew 10-fold from 2019, Newsom’s first year in office, and 2020, when the pandemic arrived.

Facebook contributed nearly $27 million to the Democratic governor’s causes, mostly for gift cards to nursing home workers. Blue Shield of California gave $20 million toward homeless programs. Those companies were the two top donors, said the Fair Political Practices Commission, which oversees and enforces California’s campaign finance and political ethics laws.

Listed beneficiaries include the governor’s office for $42.5 million and the Governor’s Office of Emergency Services for $26 million. There was also money supporting California’s Alzheimer’s Task Force, Newsom’s California Climate Action Corps initiatives, a California Climate Day of Action, and consulting services for the administration’s Master Plan for Aging.

While California limits the amount of gifts and campaign contributions to politicians, there are no limits on behested payments. They are reportable only if they are made at the suggestion of a public official to someone else for a legislative, governmental or charitable purpose, and only if payments from a single source reach $5,000 in a calendar year.

“Unprecedented times, call for an unprecedented response,” Newsom spokesperson Daniel Lopez said in a statement.< height=”242″>He said the governor “has been committed to utilizing the innovative spirit of our private sector” and is “leveraging that strength to help improve the lives of all Californians.”

There is no suggestion that Newsom or his donors acted improperly. But critics say that while the payments don’t directly benefit the politician, they can indirectly curry favor.

For instance, former Gov. Jerry Brown repeatedly sought contributions from casinos, labor unions, wineries, insurers and major corporations to benefit the Oakland Military Institute charter school he founded in 2001 when he was mayor of the city.

Despite the nature of such behested payments, Lopez said hundreds of companies including Facebook and Blue Shield reached out to the governor’s office, not the other way around.

Campaign watchdogs fall into two camps on behested payments, said Loyola Law School professor Jessica Levinson, former president of the Los Angeles Ethics Commission.

Some believe such contributions “are the devil’s work, and they’re clearly a loophole around contribution limits and people just give them to curry favor with elected officials,” she said.

She tends to fall into the second camp, that money will inevitably flow through politics and would otherwise go to campaign accounts or independent expenditure committees.

“So if people are going to try and curry favor with elected officials, which they will, then let’s at least have that money go to a good cause,” she said.

She said the big issue is having the payments be transparently disclosed, so voters can make informed decisions on the donations and outcome.

“Not every behested payment is nefarious, but every behested payment deserves scrutiny,” said Jonathan Mehta Stein, executive director at the good government group California Common Cause. “And the explosion of behested payments recently certainly creates a perception among the public that corporations and players in state politics are using this as an avenue to get around our pay-to-play rules.”

Blue Shield and Facebook, now Meta, each said they were proud to help Californians during an unprecedented pandemic.

Aside from the governor, behested payments can be be made on behalf of numerous local and state officials, including lawmakers and statewide officeholders.

Several other states including Alabama, Florida, Hawaii, Maryland, New Mexico and New York limit or prohibit such solicitations to benefit third parties, according to California’s ethics panel.

Newsom mentioned some of his contributors in his near-daily news conferences in the early stages of the pandemic, providing publicity for some donors.

Ethics commission spokesman Jay Wierenga said requests for donations can take various forms and don’t have to come from the governor himself. They could begin with a casual request by a governor’s aide at an event or with a formal solicitation letter, and the nature of that request doesn’t have to be disclosed, just the result.

Payments made at Brown’s request topped out at less than $11 million in 2018, his last year in office, and Newsom’s at about $12 million in 2019 when he took over and sought money to pay for his inauguration festivities and various governor’s task forces.

Newsom kicked such donations into an entirely new gear in 2020.

In 2019 there was one contribution topping $1 million. The next year there were 50. Contributions between $500,000 and $1 million jumped from three to 18.

The overall amount of state behested payments in 2020 was more than 30 times higher than the 2016 amount. Substantial increases also occurred in reporting at the local level, the commission said.

The soaring use shows “the continued importance of transparency in making sure our elected officials are accountable for the vast amounts being raised, even if they are going for very worthwhile efforts,” said commission Chairman Richard Miadich.

o the commission now requires officials to disclose any ties they may have to a non-profit receiving the money, and if the person making the payment is involved in a proceeding before the official’s agency.

That increased disclosure is a good step, said Mehta Stein, but he said the Legislature should flatly prohibit solicitations that benefit an office-holder’s spouse or other relative.

Among other donors, Google gave $10 million toward California’s COVID-19 public health awareness campaign, while Fox, YouTube, TikTok, Twitter, Snapchat, Spotify, Netflix, Pandora, Comcast, ABC and NBC were among those contributing lesser amounts.

Blue Shield’s $20 million went to support Project Homekey, Newsom’s program to use vacant hotels, motels and other unused properties as permanent supportive housing for residents without a place to live.

Tens of millions more from Kaiser Foundation, IKEA US Community Foundation, the Chan Zuckerberg Initiative and individual donors Reed Hastings and Tom Steyer all went to California’s COVID-19 Response fund.

California-and-DC-Politicians-Are-Paid-Bribes-With-Google-Facebook-and-Tesla-Stock-Warrants

“This is decades and decades of failures from California politicians taking bribes from Developers and Real Estate Lobbies,” experts say

MODERN FORENSICS TRACES ALL OF THEIR SECRET BANK AND STOCK ACCOUNTS WHERE THE BRIBES GO!

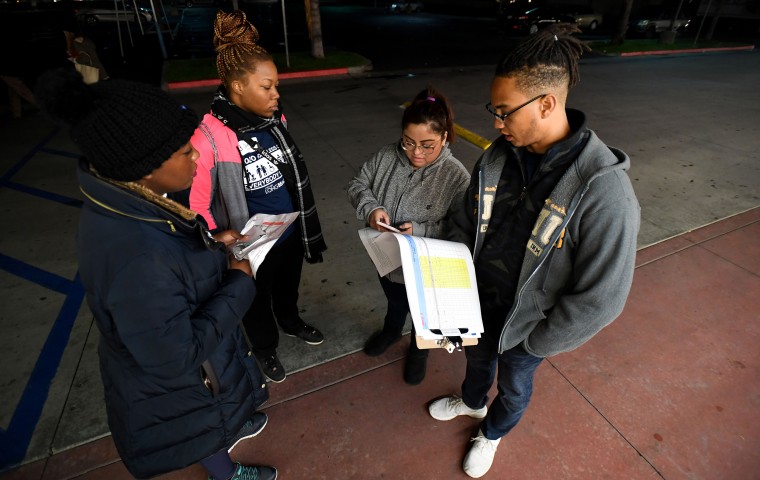

Kayla Haskell, homeless outreach specialist with Pathways to Housing DC, from right, interviews David Putney, 64, who has been homeless for two years, near the McPherson Square Metro Station in Washington on Jan. 22.Katherine Frey / The Washington Post via Getty Images

LOS ANGELES — The only thing that kept LaRae Cantley going was her three children.

She grew up surrounded by poverty and addiction, but despite her difficulties, she never expected to be homeless.

Yet one day in the late 1990s, a sheriff’s deputy knocked on the door of her South Los Angeles house and told her and her husband they had five minutes to vacate the property. Cantley was stunned. She knew nothing about her husband’s finances and had no idea he skimped on rent.

With nowhere to go, she sent their three children to live with the children’s great-grandparents. She and her husband divorced, and she found herself homeless.

“There was nothing to catch us,” she said.

Cantley, 37, lived on the streets for 15 years. She was among thousands of Californians without a home, a problem that continues to grow. Last year, homelessness rose 16 percent to 151,000 people.

Many blame mental illness and drug addiction for the soaring numbers, but experts say that is only part of the puzzle. The state’s severe housing shortage that has forced rents to increase at twice the rate of the national average and put the median price of a single family home at $615,000, has also contributed to the crisis.

John Maceri, CEO of the Los Angeles-based social services provider The People Concern, said social safety nets, like affordable housing and job training, are all but gone, leaving already vulnerable people to fend for themselves.

“You reap what you sow,” Maceri said recently.

He was one of 300 volunteers who gathered in Santa Monica last week for an annual homeless count, part of a larger effort in Los Angeles County that spanned three days and covered thousands of square miles. Similar counts took place in San Francisco, San Diego and other parts of the country.

The federally mandated survey stretches to every nook and cul-de-sac. Its mission is simple: using U.S. census tracts, count every person who appears to be experiencing homelessness and report those numbers to the county. The county tallies them up using statistical analysis and sends them to the state, which sends a report to the U.S. Department of Housing and Urban Development.

Similar to the census, the federal government doles out resources based on these findings. Cities and counties with the most need typically get the most money.

In Santa Monica, an idyllic coastal oasis in Southern California, the count took on the air of a community fair. Parking attendants ushered hundreds people into St. Monica Catholic Church on a Wednesday night, offering warm drinks and snacks to volunteers who greeted one another. The crowd filled with local residents and city officials was thick with anticipation.

Around 11 p.m., hundreds of volunteers, lawmakers and law enforcement officers embarked on what has become routine for the affluent community. The city was an early adopter of the count, said former mayor and current state Assemblyman Richard Bloom.

The Democrat served three terms as Santa Monica’s mayor when homelessness still felt like a local problem. The city, with its soft beaches and year-round sunshine, had always been a magnet for homeless people. Residents and outsiders sang a familiar refrain: People experiencing homelessness were drawn to Santa Monica’s comfortable environment and abundant social services.

“Homelessness has been here for decades,” Bloom said. “But for many of those decades, we really didn’t see it as much as we do today.”

In 2005, when Los Angeles County conducted its first count, more than 82,000 people were reported as homeless, according to the Los Angeles County Homeless Services Authority. By 2019, that number had dropped to 59,000.

Experts say these fluctuations reflect the issue’s complexity and enormity.

“This is decades and decades of failures,” said Heidi Martson, interim executive director of the homeless services authority. “It’s going to take time.”

One of the biggest failures has been state and local leaders’ inability or unwillingness to address the high cost of housing. Nearly half of Los Angeles County residents pay 50 percent of their income on rent, according to the housing authority. Even building affordable housing in Los Angeles was estimated in2016 to cost $414,000 for a two-bedroom unit, according to a city of Los Angeles report “Comprehensive Homelessness Strategy.”

Los Angeles County finds housing for 130 people every day, yet 150 people fall into homelessness daily, according to the authority.

“This is truly poverty,” Martson said.

Two other factors repeatedly come up in discussions about homelessness in California: Gov. Ronald Reagan signing the Lanterman-Petris-Short Act in 1967, which ended the practice of admitting patients into psychiatric institutions against their will, and Gov. Jerry Brown reducing the prison population after a federal three-judge panel ordered the state in 2009 to cut the inmate population by 46,000 people.

Neither move came with social safety nets, such as job training and mental health treatment, to ensure these people would land on their feet, said Alise Orduña, Santa Monica’s senior adviser on homelessness.

“We needed to help people readjust to society,” she said.

Cantley said she first signed up for housing through the city in 1998, but didn’t receive it until 2012. After spending more than a decade on the street, she found herself at odds with the walls and routines thrust on her.

It took her three years of “damage control” to adjust, she said. She’s not alone. In recent years, a new trend has emerged among service providers to pair formerly homeless people with support services.

For Cantley, that meant counseling for domestic abuse and depression, she said. Now, she is an advocate and activist who works with others with similar experiences. But not all people enduring homelessness are able to access those types of resources.

Mike Sanders spent six years in prison for robbery before his release in 2015. During his time behind bars, his mother died and the rest of his family became financially unstable. With no money and no job, Sanders, 43, became homeless. He slept on skid row in downtown Los Angeles for awhile, but it was too dangerous, he said. Church steps and shelters felt safer.

Eventually, he signed up for housing through The People Concern and found a stable home three years later, he said. Now, he lives in a former hotel near 5th and Spring streets downtown, he said.

“I love it,” Sanders said of his home. “I don’t have to share my room, my bathroom, with no one.”

Still, Sanders does not work. His income filters in through panhandling and the state’s General Assistance program. He spends his days circling downtown in a wheelchair, getting food and cash where he can.

The Bay Area’s dynasties and Dianne Feinstein’s CBRE Realty go to great lengths to keep affordable housing out of California.

Some of them pay epic covert bribes range from small family businesses to juggernauts—and include everything from philanthropy to sex scandal, all from some of America’s wealthiest families.

Here’s a look at 5 headline-making bloodlines.

1. Sobrato Cartel, Founded: 1979 The Founder: John A. Sobrato (pictured) History: John A. Sobrato’s father, John Massimo Sobrato, owned a famous Italian restaurant in San Francisco. When he died, John’s mother Ann sold the restaurant for $75k and invested the proceeds in South Bay properties. John took over the business in the early 1960s before starting his own company, the Sobrato Organization, in 1979. Famous Members: John’s son, John M. Sobrato, is the CEO of the family business, while John remains chairman. Sue Sobrato, John’s wife of 50+ years, is a trustee, along with daughters Sheri and Lisa, and Lisa’s husband Matthew Sonsini. The Latest: Following in the footsteps of Ann Sobrato, the charitable family has donated more than $300M to local nonprofits since starting a family foundation in 1996. The Sobrato Family Foundation, set up by daughter Lisa, has provided 68 nonprofit organizations with more than 333k SF of operating space, at a value of roughly $5.5M. John and Sue, along with their son John M., have also signed giving pledges promising 100% of their wealth—an estimated $6B to date – to charity either during their lifetime or upon their death. Famous Properties: The Sobrato Organization owns 7.5M SF of office space in Silicon Valley, with tenants like Apple, Yahoo and Netflix. The firm also owns 6,600 apartments.

2. Shorenstein Cartel, Founded: 1960 The Founder: Walter Shorenstein History: Walter Shorenstein bought Shorenstein Co (then named Milton Meyer & Co) in 1960. He changed the name in 1989. Famous Members: Walter’s son Doug (pictured) ran the company until this past November, when he lost his battle with cancer. Walter’s daughter Carol Shorenstein Hays is a Tony Award-winning theater producer many times over. The Latest: Doug, known for his uncanny instincts regarding real estate, turned the company into a powerhouse, with the firm boasting over 70 properties in 13 cities, including LA, Portland, New York and San Francisco. Walter and his wife also started the Joan Shorenstein Center on Press, Politics and Public Policy at Harvard’s Kennedy School of Government in honor of their late daughter Joan, who was a journalist at the Washington Post and CBS News. Walter passed away in 2010 at the age of 95. Famous Properties: Under Doug’s leadership the company purchased such high-profile properties as Miami’s Wachovia Financial Center (formerly First Union Financial Center), and the Starrett-Lehigh Building in New York. Other iconic investments include Chicago’s John Hancock Tower and New York’s Park Avenue Tower. Fun Fact: Walter Shorenstein and a group of investors bought the San Francisco Giants in 1992 for $100M, and Walter acted as an adviser to Presidents Johnson and Carter.

3. Bechtel Cartel, Founded: 1898 The Founder: Warren A. Bechtel (pictured with his wife, Clara) History: Warren started Bechtel engineering and construction company when he was just 25 years old and nearly bankrupt, with a new baby on the way. Famous Members: When Warren died unexpectedly, he was succeeded by his son Stephen Bechtel Sr., who became chief executive of the Hoover Dam project. His son Stephen D. Bechtel Jr. took over in 1960 and ran the company until 1989, when he handed it over to his son Riley. The Latest: Riley stepped down as CEO in 2014, and today the company is run by his son Brendan, who is president and COO. That’s five generations. The company has 58,000 employees in nearly 50 countries. Famous Properties: The firm is known for such iconic projects as the Hoover Dam, the Channel Tunnel, Crossrail London and the Tacoma Narrows Bridge.