As Tyler Aquilina says: With the performers of SAG-AFTRA now joining Hollywood writers on the picket lines, it’s clear that the ultimate resolution of this crisis will be decisive for the future of the entertainment industry and its workers. Whatever contracts are hammered out once bargaining between the guilds and the studios resumes will likely set the standard for Hollywood’s new compensation models going forward.

The big studios will do anything to keep the world from seeing that modern generations don’t want to watch the pandering, woke crap produced by the good old boys of Hollywood. Their play to the lowest common denominator has been an epic failure…bigger than usual. Only independent production can save media now. Nobody needs actors and set builders. AI will do it all, for less money, from now on.

“influencers” are never going to save media. Every single one of them are self-centered, narcissist school girls and frat boys that think the world revolves around them and eventually suicide…not a good business model.

As VIP+ has argued, the paramount economic issue at stake here is streaming residual payments, which will form the backbone of entertainment industry workers’ compensation in the years to come. At the heart of this dispute is streamers’ reluctance (to put it mildly) to share data quantifying viewership of content on their SVOD platforms; the studios have evidently refused to engage on the issue of success-based residuals for such content.

Under their now-expired agreements, SAG-AFTRA and WGA streaming residuals are calculated based on a service’s domestic subscriber totals, with a sliding scale of tiers determining the amount talent will be paid. Contractual residual bases are multiplied by the corresponding “subscriber tier” percentage as well as another percentage based on how many years it’s been since the content in question was released.

In other words, unlike the methods used to calculate TV residuals for decades, there is no accounting for the performance of hits in this model, and the studios are evidently unwilling to change that. The new contract the Directors Guild negotiated with the Alliance of Motion Picture and Television Producers (AMPTP) contained no provision for success-based residuals, instead simply increasing required payments and adding a new formula to better account for international subscribers.

Yet any subscriber-based formula already looks antiquated, given that subscriber totals are no longer the chief arbiter of success in the streaming business. And as that business continues to mature, basing residual payments on this metric will become less and less effective as a compensation model, as streaming transforms into a stable, long-term business supported largely by advertising — transforms, in other words, into something more like television.

The bitter irony here is that studios clearly know they can’t keep a black box around streaming viewership data forever. All the major-studio SVODs now participate in Nielsen’s streaming ratings system, which measures only viewing on TV screens in the U.S., and are also actively exploring alternative ratings currencies to better measure viewership across all types of screens and platforms.

The larger issue, and perhaps an under-discussed contributor to the current unrest, is that despite the studios’ reticence to share their own data, there is also no standard third-party streaming viewership metric they can agree to utilize, and currently no simple number that quantifies the success of streaming content.

“There is not a good, consistent streaming metric of success for [SVOD] shows, and that is a huge problem,” Variety Senior TV Reporter Joe Otterson said during last week’s VIP+ webinar on the strikes. “If you say, ‘On Thursday night at 9:00, 10 million people tuned in to watch this show on CBS,’ people can wrap their minds around what that means in terms of the success of that show….But when you tell someone, ‘This show has been watched for 95 million hours since it was released two weeks ago’? I cannot wrap my mind [around] or contextualize exactly what that means.”

SAG-AFTRA reportedly attempted a compromise on this front, suggesting data from Parrot Analytics be used to calculate streaming content’s popularity and contribution to services’ revenues, a proposal the studios rejected.

However, this gets no closer to a true solution to the problem, as Parrot’s “demand” metric is a poor proxy for streaming viewership data to tie to residuals. There are too many factors at play in these scores — social media engagement, search engine activity, piracy — that reflect audience interest in a title but are not concretely tied to actual viewership on a streaming platform.

How, then, should the guilds and the AMPTP compromise? Perhaps the search for a third-party viewing metric for ad-supported content could be a bridge to measuring ad-free programming as well? Some of the studios this year launched a Joint Industry Committee to vet and certify new audience-measurement technologies for the purpose of establishing a standard currency for advertisers; if the studios want to reach a compromise to end the strikes, one would think they could invest in landing on a metric that would work for the guilds too.

The problem, however, is that the major players can’t even agree on what metrics to use, or even whether new metrics should be used at all: Disney and Netflix, for instance, plan on sticking with Nielsen and aren’t involved in the JIC. Meanwhile, the other studios are unhappy with Nielsen’s audience measurements (hence the search for new currencies), and likely wouldn’t agree to have any success metric tied to Nielsen data.

But the fact remains that a measurement system will, eventually, need to be agreed on. As noted, advertising will only become more important to the streaming business in the years ahead as subscriber totals continue to plateau, and advertisers will need a standardized streaming viewership metric to measure the reach and impact of their investments.

If this won’t crack open the doors of streamers’ own data vaults, it will at least shine a brighter light on streaming viewership, and weaken the studios’ case for keeping this data in the dark. Of course, the streamers would almost certainly prefer to keep data strictly shared with advertisers, but more data being shared means more potential for leakage, and again, would dilute the studios’ argument for keeping such data from the guilds.

In other words, we’re likely moving toward an era of greater data transparency whether the studios like it or not, and the guild negotiators would do well to keep that in mind when contract talks eventually restart.

Here’s why Hollywood’s in real trouble…

1. The Death of Cable/Satellite/Linear TV

“Cable/Satellite/Linear TV” is non-streaming TV, where you pay for a package of channels every month—ESPN, CNN, Turner Classic Movies, Fox News, etc.

For the sake of simplicity, I’ll use the term “pay TV.”

Although I’ve been writing about the imminent death of pay TV for more than a decade, no one else really has. There’s a reason why this consequential story has been deliberately underplayed: pay TV is the one-legged stool propping up the entertainment industry.

The importance of pay TV is rarely discussed in the media because the entertainment industry wholly owns the entertainment media. If the media covered this issue with the seriousness it deserves, stock prices would fall. Entertainment companies are judged solely by their stock prices, and the entertainment media will never risk damaging their patrons.

Entertainment companies made billions from pay TV for decades, year in and year out. But those dollars were not earned on merit. If you’re wondering why you pay $175 a month for a bunch of channels you never watch that still serve up 20 minutes of ads per hour, here’s why: a major chunk of your $175 goes to entertainment companies. So let me repeat my main point: none of that money is based on merit.

Merit means Hollywood makes money based on what people actually watch. Pay TV successfully circumvented merit with a rigged system where you pay for dozens of channels you never watch.

Want proof? Look here… That is last week’s list of 118 pay TV channels. The “P2+” column reveals the average number of total viewers in thousands. As you can see, out of 118 channels, only two(!) average more than a million viewers. Only 13 average more than 500,000. Only 33 average more than 250,000. Question: how many of these 118 networks could survive on merit—advertising revenue based on ratings? Maybe five? Nevertheless, Hollywood still makes a ton of money from over a hundred channels that fewer than a million people watch because pay TV customers pay for those channels.

How sweet is that?

But.

Thanks to streaming, those days are coming to an end. Already, the number of people who have canceled their pay TV subscriptions (cord-cutters) has been enough to hurt Hollywood’s bottom line.

Americans now want to stream, and the problem with streaming is that, unlike pay TV…

2. Streaming Services Are Merit-Based

Pay TV will always be around. The problem is that within the next ten years or so, there will not be enough pay TV subscribers to sustain all those channels no one watches. So…

Every entertainment corporation has launched a streaming service hoping the streaming boom will automatically replace those pay TV billions. Oops. Other than Netflix, those streaming services are losing billions. Disney alone has lost upwards of $10 billion on Disney+.

The result is this [emphasis original]:

Two years ago … [Disney’s] stock price was a buoyant $176. On Friday, the stock closed at $87.

Over the same period, Shari Redstone’s Paramount Global has plummeted from $40 on July 21, 2021 to $15.50, and shares in Jim Dolan’s AMC Networks have slid from $52 to $13. Indeed, even factoring in the Netflix correction of last year, entertainment stocks are still down an additional 30-50 percent.

Without the financial affirmative action that is pay TV, these companies must survive on merit (e.g., people pay directly for the product), and these companies cannot survive—at least not at the same level—on merit because…

3. Pay TV Made Hollywood Lazy and Mean

When merit had nothing to do with Hollywood’s massive profits, three things happened to the industry: 1) it got lazy, 2) cocky, and 3) politically divisive.

Why put effort into creating great content if you make the same amount of money for no effort?

One of the primary reasons Hollywood content is so awful and repetitive (Fast & Furious 10, Indiana Jones 5, and all those Law & Order, CSI, and NCIS franchises that never die) is because “awful and repetitive” is good enough when 120 million households pay for all that “awful and repetitive” content (they do not watch) through their pay-TV bill.

There’s no reason to offer anything new or good when three million viewers are enough to describe your TV show (no one watches) as a hit.

Look at these viewership numbers from earlier this month.

Now look at these numbers.

Pay TV killed merit.

When all that unearned money flowed in, Hollywood also got cocky and arrogant. This is why Hollywood had no problem insulting, demeaning, and alienating half the country. When merit has nothing to do with profits, it is perfectly safe to make your content left-wing, gay, anti-Christian, and culturally bigoted. Why not? We rubes are so addicted to Fox News and live sports we’ll still pay for networks like CNN that propagandize for our destruction.

But now that streaming means profits can only be made through merit, Hollywood has painted itself into one corner where it has lost half the country as a potential customer base. The second corner is an industry without the talent to create quality content.

Look at this… Somewhere around 350 TV shows debuted just last year, and it’s almost all garbage no one watches—quantity over quality to fill the schedules of cable networks no one watches and streaming services that lose billions. Without pay TV’s affirmative action billions, that is not sustainable.

4. The Woke Prison

With billions and billions of unearned dollars pouring in from the old pay-TV model, Hollywood stopped worrying about quality, stopped worrying about serving Middle America, and felt secure turning their companies over to the Woke Nazis. Disney is so politicized it has openly embraced grooming and sexualized its children’s content.

Jerod Harris; Alberto E. Rodriguez/Getty Images/Lucas Film/Disney, BNN Edit

Here’s the problem…

Now that these companies will have to make money based on merit, merit will not be allowed.

Once the Woke Parasites infest something, they never let go or compromise. For example, suppose Disney decided to save itself the only way it could: by returning to its roots of quality and wholesome programming. In that case, the Woke Nazis will destroy the company from within (CNN is in the same fix if it ever decides to be an honest, objective news outlet).

The Woke Nazis demand everything be openly, stridently, and belligerently political, which destroys any chance of quality content that might attract a mass audience—which in turn means your streaming service will continue to lose billions.

The woke tail is wagging the dog, and there’s no escape.

5. Free TV Is Making a Comeback

TV used to be free. No one paid for TV until cable TV came along. People are rediscovering this. If you live near a metro area, a $25 antenna will deliver all kinds of free channels, including the broadcast networks. If you already pay for the Internet, streaming services like FreeVee, Tubi, Redbox, and Pluto offer a countless number of free channels that deliver a countless number of movies, TV shows, sports, news, reality, DIY, and true crime programming. Why anyone would pay for TV today is beyond me.

6. The Writer and Actor Strikes Expose a Paper Tiger

The strikers want a higher percentage of profits that don’t exist.

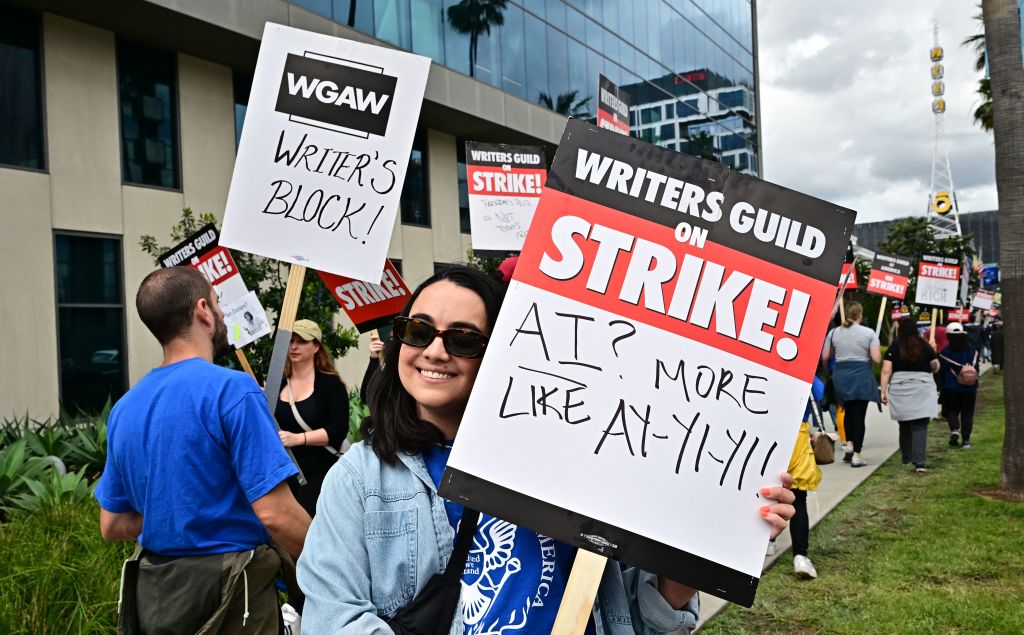

Actors on strike carry signs outside Amazon Studios in Culver City, California, on July 17, 2023. (AP Photo/Chris Pizzello)

Writer Ilana Pena holds her sign on the picket line on the fourth day of the strike by the Writers Guild of America in front of Netflix in Hollywood, California, on May 5, 2023. (FREDERIC J. BROWN/AFP via Getty Images)

Streaming services are losing billions, pay TV is dying, movies are not making a comeback, and entertainment stocks are sinking.

Where exactly are the profits?

Here’s what terrifies the industry more than anything… The strikers want residuals on streaming content. For that to happen, streaming services must release viewership data on streaming shows, something they have adamantly refused to do. You see, the streamers don’t want Wall Street to see this data. Once Wall Street discovers no one is watching 340 of those 350 shows linked above, the stock will take an even deeper dive.

I would summarize things this way: the death of pay TV and the loss of those unearned billions is crippling an out-of-touch industry that alienated half the country and no longer knows how to create quality content. Worse still, the takeover of these companies by rabid leftists ensures these companies will not even try to win back the masses.

I don’t know how this will shake out over the next decade or so, but we’re only in the first act of this long overdue reckoning, and I’m sure enjoying the show so far.